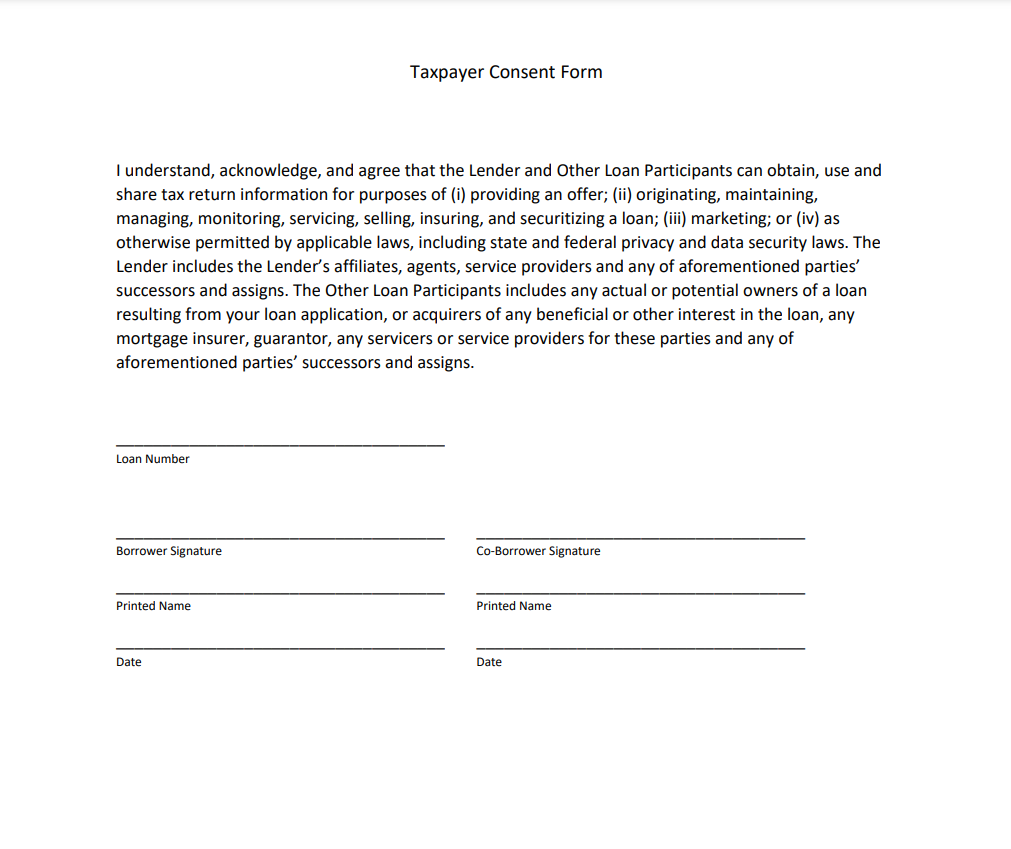

Taxpayer Consent Form Mortgage – An agreement between taxpayers form is a legally binding document that defines the conditions for a mortgage. It can be requested by lenders when a person seeks a loan for their home. Credit unions must consult with their legal advisor prior to creating the consent form as tax and contract law are extremely complex and may differ significantly. Fortunately that there is a template available. Mortgage Industry Standards Maintenance Organization (MISMO) has developed the tax payer consent Form. The form is believed to be approved from the industry of mortgage and includes a basic consent agreement.

Taxpayer First Act

The Taxpayer First Act was passed into law on July 1st, 2019, and will make it more difficult the lenders share taxpayer data with anyone. This law will require lenders to seek the permission of the borrower prior to being able to disclose this information to a third person, such as an investor who may be in the market. The new law states that mortgage lenders will not be permitted to share tax return of a borrower without the permission from the person who is borrowing.

Both borrowers and lenders must get the borrower’s consent in writing prior to sharing tax information. For example, the IRS form 4506-T forms an example of kind of form and lenders need to ensure they have the borrower’s consent in writing prior to sharing information. The tax information should only be used only for the purpose the purpose for which it was designed, and it is essential to let lenders know this in advance. Additionally, mortgage lenders should ensure that they share tax return data only with third parties who are interested in it.

Requirement of consent for re-disclosure

The IRS has said that it is not planning to make a taxpayer-consent form to collect tax information from those who borrow. In the meantime, the Mortgage Industry Standards Maintenance Organization (MISMO) has developed a model language for the taxpayer-consent form and lenders can create their own tax return declaration consent forms. However, it is crucial that a borrower grant their permission in writing to disclose tax information prior to mortgage servicers are able to access the information.

The Taxpayer First Act requires organizations to create an additional form which specifically addresses the re-disclosure agreement of the borrower. The form is not required for all lenders. Therefore, it is essential to talk with your legal department and compliance department prior to making a decision on whether you should provide an independent form. The lenders also differ in their ways of doing business, so it is essential to establish whether consent was obtained promptly.

There are third party software companies which require consent for re-disclosure

These new consent regulations require lenders to obtain the borrowers’ separate agreements on disclosure for the use of confidential taxpayer information. The new regulations demand that lenders seek borrowers’ express consent prior to using tax data for mortgage loans. Although the IRS has not provided an example form but it has provided an template that can be downloaded from its website. The template form is approved by mortgage companies. However, many credit unions remain unclear about the legal implications of the form.

Download Taxpayer Consent Form Mortgage 2024