Taxpayer Consent Form – What are the key points to be looking for on an IRS taxpayer consent Form? What length of time can a tax payer be able to consent to the use of or disclosure of details from their tax return? What kind of proof is required? Do you need electronic documents? How do you know whether the form was signed correctly? This article provides crucial aspects to consider. I hope that you will be able to use it. Make sure you follow these guidelines: Taxpayer Consent Form.

Perpetuity of the taxpayer’s agreement to disclose or use tax return data

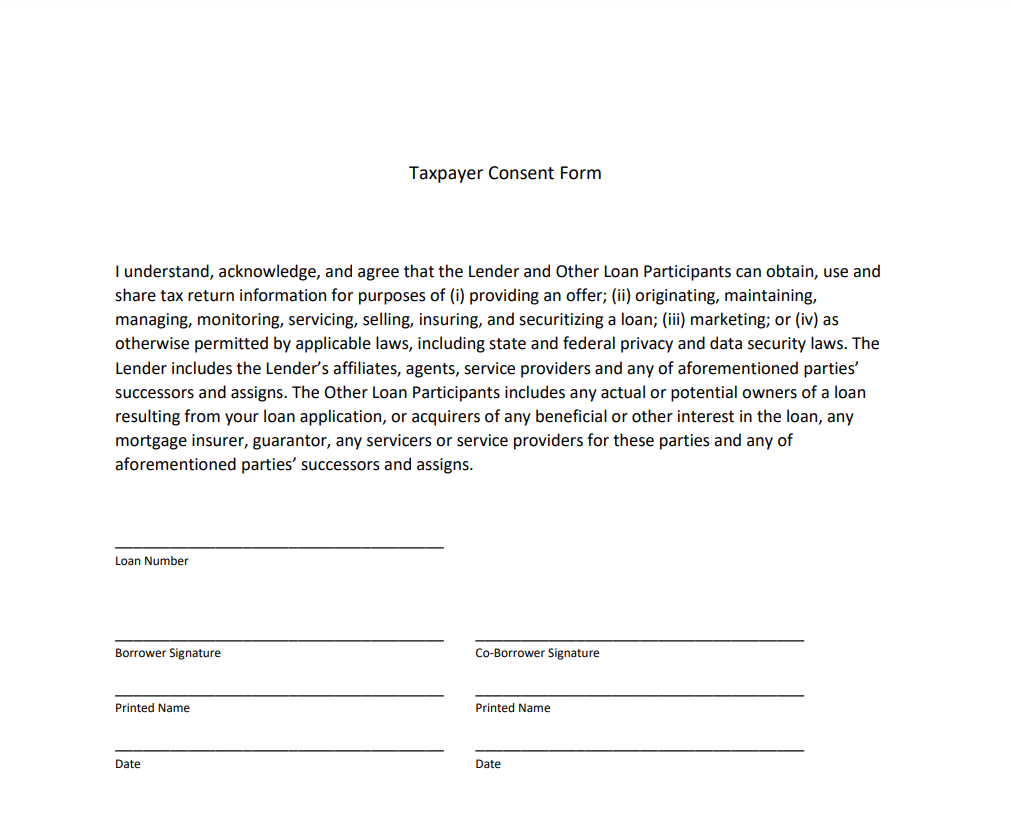

A federal law demands that taxpayers sign the consent form prior to allowing a third person to use or divulge information about their tax return. Without consent, information can’t be used for any purpose other than preparation or filing of tax returns. In many instances the consent to divulge information might not be covered under federal law. If you have questions regarding whether or whether your consent is valid, inquire with your tax preparer or accountant.

Before any tax preparer is allowed to use or divulge tax return data, they must have a signed consent. The consent must state who will be notified of the information and the reason for disclosure. The consent form can be given in person, electronically or via fax or postal mail. It is crucial to be aware that the tax returns preparation expert can’t fill out the consent form on behalf of taxpayers.

Documentation is required

Before a tax professional begins the process of submitting the taxpayer with a consent form the tax preparer must determine the exact items or services to be provided. The products and services could include mortgage loans, mutual funds, individual retirement accounts (IRAs) the, life insurance and many more. The services need a distinct agreement with the signature of the person who is paying the taxes. If the taxpayer is unwilling to accept the form, it’s possible for the person who prepared it to include this document in an engagement letter.

In the majority of cases, a consent form must include the name of the taxpayer as well as that of the person who prepares the taxes. The consent form can be signed on either electronic or paper forms, or both. A consent form for the taxpayer form must not contain an assertion that the tax preparer is legally authorized to disclose or use the information of the taxpayer without the permission of the taxpayer. If tax preparers are providing the consent of the taxpayer electronically, the tax preparer has to ensure that the taxpayer has the power to approve the electronic transfer of tax return details.

Electronically signed forms

In an effort to cut down on the number of contacts in person to file federal tax returns To reduce the need for in-person contact, the IRS has recently expanded its list of acceptable forms to allow signatures electronically. The announcement is specifically focused on digital signatures. However, it doesn’t mention scanned images. This change in the law is designed to lower the likelihood of taxpayers being sick during the COVID-19 epidemic. But, taxpayers should continue to mail forms that have the digital signature.

However, it is true that there are a number of concerns have hindered the widespread use of electronic signatures for paper forms. One of the most significant worries is that tax professionals could be unsure of what is an appropriate electronic signature. In general, an electronic signature is an image that has been created by a application that can support electronic signatures. Although this type of technology may not yet be widely utilized however, the IRS has declared that it will allow taxpayers to utilize the technology up to 2021.

Download Taxpayer Consent Form 2024