Barclays Occupiers Consent Form – A mortgage lender will utilize the Barclays Occupiers Consent form to confirm the tenant’s identity. The mortgage application procedure would not be complete without this form. However, it might lead to a number of issues for both mortgage lenders and occupants. We’ll examine some of the issues in this article.

mortgage company

An occupier’s consent form may need to be signed by the owner of a property that is subject to a Barclays bank mortgage. Your mortgage lender may have issues if you fail to sign a document. You must complete this form in order to receive legal possession of the property.

Barclays uses two different consent forms: a council tax form and an occupiers consent form. This occupier permission form is necessary to document your understanding with the property’s occupier. When you apply for a new mortgage or refinance your property, you also need to submit an occupants consent form.

You must get independent legal counsel prior to signing this document. Consult an estate agent or lawyer if you have any questions concerning the agreement. It is important to seek independent legal counsel because the occupier will be required to sign this form by a mortgage lender.

Form of occupancy consent

A legal document called the Barclays occupier’s permission form is used to verify the occupier’s agreement to Barclays’ business operations. The company is a financial services company. Zoopla, Robert Cullen, and Sen After Profits are some of its tenants.

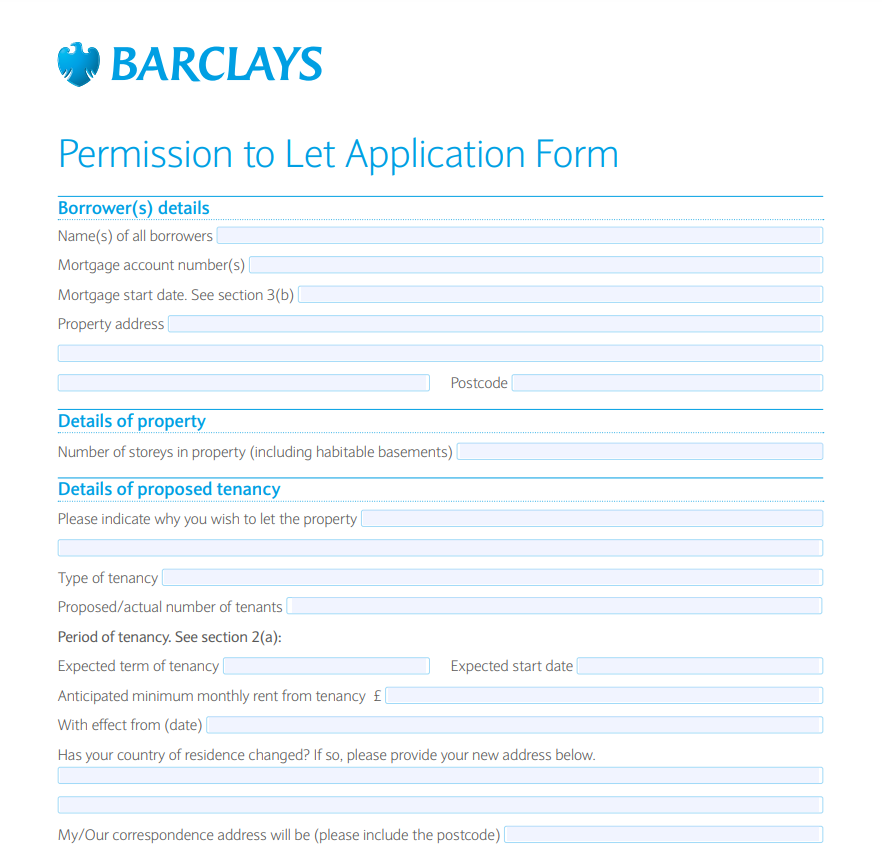

All you have to do to use the occupier’s consent form is complete the necessary fields. The form needs to be delivered to the Irish Barclays bank. You should next proceed to the property and move in. After then, you can pay the property’s rent. You can avoid having to put down a deposit on your house in this way.

If you intend to remain in your house, the occupier’s consent form is crucial. You can have issues with your mortgage lender if you don’t fill it out. You can indicate on the form whether you share the home with another person or are the only occupant.

Issues facing mortgage lender

Customers of Barclays Mortgage have reported issues with their records. They are unable to refinance their loans into more affordable arrangements since some have been incorrectly classified as defaults. Others have voiced complaints about receiving excessive pay or experiencing frequent defaults. The effects of a default on your credit file can be disastrous, regardless of the cause. It can make it more difficult for you to receive a loan or credit card, and it might even make it impossible for you to transfer mortgages.

You will certainly need to get an occupiers consent form if you want to buy a home and want to lengthen the mortgage term. But this can cause issues for your mortgage lender. The majority of UK lenders demand this form. It will grant the residents a title to the property.

Issues facing occupants

You must carefully read the Barclays occupiers permission form, which is a very significant document. It comes at a significant financial expense to both you and the Barclays bank. It also entails the responsibility of disclosing details about your property. In essence, it says that you authorize the Barclays bank to handle your property in a certain way.

The occupiers’ approval is noted on the Barclays occupiers consent form during the execution of the executor’s order. Numerous tenants of the business include Robert Cullen and Zoopla.

A court order and the Barclays occupiers consent form are comparable documents. It must be signed by the owner or occupant. You can seek legal counsel if you’re not sure if you want to accept the agreement.

Download Barclays Occupiers Consent Form 2024