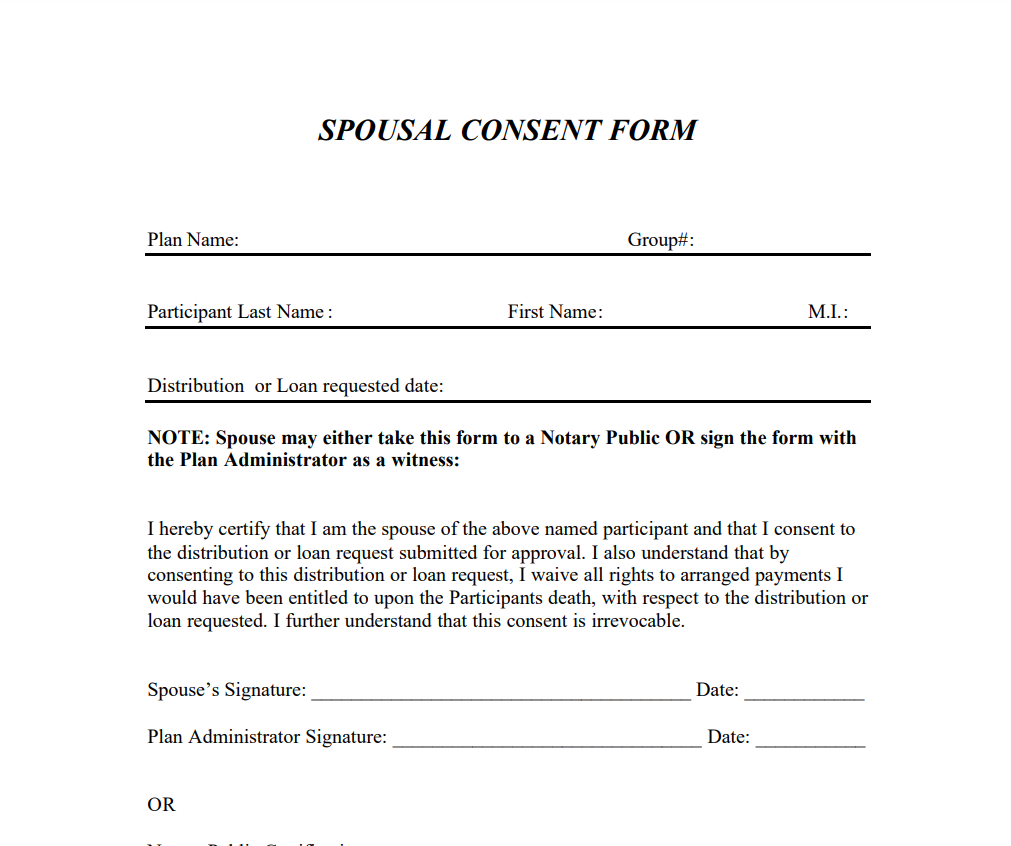

Spousal Consent Form – The REA mandates the use of the use of a Spousal Consent Form to make certain distributions from pension plans that are qualified. Although IRAs aren’t subject to the spousal consent requirement However, other retirement plans like QJSAs and indirect IRRs might require the form. This article will examine the types of retirement plans that are exempt from the requirement for consent from a spouse. Here are a few instances of plans for retirement that don’t require consent from a spouse. Spousal Consent Form.

Documentation required by REA to make specific distributions made from retirement plan qualified pension plans

The REA requires specific documentation for qualified retirement plan. Distributions under qualified retirement plans need to be documented with”the Distribution Request Form. These forms contain crucial information regarding the distribution. They are completed in the presence an official notary public. It is required to complete each section on the REA. If you are sole proprietors, the original document needs to be delivered to Schwab. In the event that your spouse is an active participant, you need to complete both of the sections of the form and then sign the document in front of an official notary public.

The REA also amends the minimum participation and vesting requirements for benefit plans for employees. In general, a plan participant has a non-forfeitable benefit if provides services during five consecutive years of the plan. Some plans, however, may stipulate that a person forfeits rights if they do not complete services in those years. In this scenario, the participant has to notify the plan within a reasonable period of time after the date of hiring.

IRAs that aren’t restricted by REA conditions for getting spouse consent

In most cases, the rules that govern community property apply for an IRA. But, the rules apply only if you’re married. Community property laws are usually different between states. This means that a couple who is married might require consent from their spouse before changing the beneficiary of their IRA. It is best to review the owner of the IRA’s IRA documents prior to making any modifications.

Another instance is one case in which the court decided that a spouse who was divorced should be eligible for an IRA. However, this was not the case. Maryland Supreme Court ruled that the prior beneficiaries’ designations were not invalidated. This case demonstrates that it’s important to sign a legally valid prenuptial arrangement. In these instances, the presence of a valid spousal agreement could help ease the burden.

QJSAs

QJSAs and spousal permission forms are both mandatory documents in the Internal Revenue Code. The waiver of participation in an QJSA requires signed consent in writing of the two of the participants. The consent of spouses is only required in the event that the spouse who died would like to receive an QJSA. The consent of the spouse is not necessary when a person is released from the service and receives the QJSA.

The person who waives the QJSA must specify the alternative form of benefit the person prefers. If the spouse of the participant is not in agreement, the participant is not able to alter this benefit once the waiver is in effect. The waiver can be modified following the death of the spouse or divorce. Consent of the spouse is required if the person wishes to alter the form of the benefit following the death of the spouse.

QJSA is a QJSA is a form of survivor and joint annuity. The plan must expressly declare the QJSA as such to guarantee it is paid. QJSA gets paid. If the beneficiary is not married, however, he could choose to not be eligible for the QJSA and opt for to receive a single one-time annuity. The decision must be made within the period of 90 days period before the commencement day of annuity.

Indirect IRRs

People who are delaying withdrawals from their retirement accounts must examine COVID-19, which requires consent from a spouse to be signed in the “physical presence” of a representative of the plan or a notary. Up until recently, this rule was highly controversial and many were dissatisfied when the IRS did not extend it beyond an additional year. However, this was not the case, and the IRS recently announced that it will not be enforcing the rule in the near future.

The Q-16 could be better than a QJSA since it has multiple form which meets QPSA requirements. The spouse who survives is required to abstain from the QPSA prior to the beginning date of an annuity. Non-annuity distributions, however do not have to be subjected to the survivor annuity obligations, however, plan administrators could consider the date of distribution as the beginning date of the annuity.

Download Spousal Consent Form 2024