7216 Consent Form – When you are preparing a 1040-series tax return, you need to get the permission of the taxpayer to disclose or use specific information on the return. In actuality, you might be wondering if you actually have to fill out Form 7216. This article will clarify whether it’s required to complete that form in order to fill it out. It’s also valid for 10 years. To start, click the button below.

Tax return preparers must get permission from the taxpayer before using or share tax return data

The IRS demands that tax preparers get permission from the taxpayer before they utilize or disclose details from their tax return. This is typically required when a tax preparer plans to make use of or divulge information from the taxpayer’s IRA that is tax-deductible. The procedure of getting the consent of the taxpayer is not difficult. Drake Software has generic Consent to Use forms available in the PDF as well as Blank Form formats. You can utilize these forms or design an individual consent form. The USE screen within Drake Software has an electronic signature option for the taxpayer. Tax preparers aren’t allowed to sign the screen.

The consent required is for the use of the taxpayer’s personal information for any purpose in business that includes marketing. The IRS does not permit tax return preparers from soliciting sales from other tax return preparation services for example, bookkeeping assistance, payroll processing, and tax return preparation. The use of this form is an essential part of IRS regulations. Additionally, the preparers must make use of the form only to utilize information that is authorized by the taxpayer.

Form 7216 is needed for 1040 series tax returns.

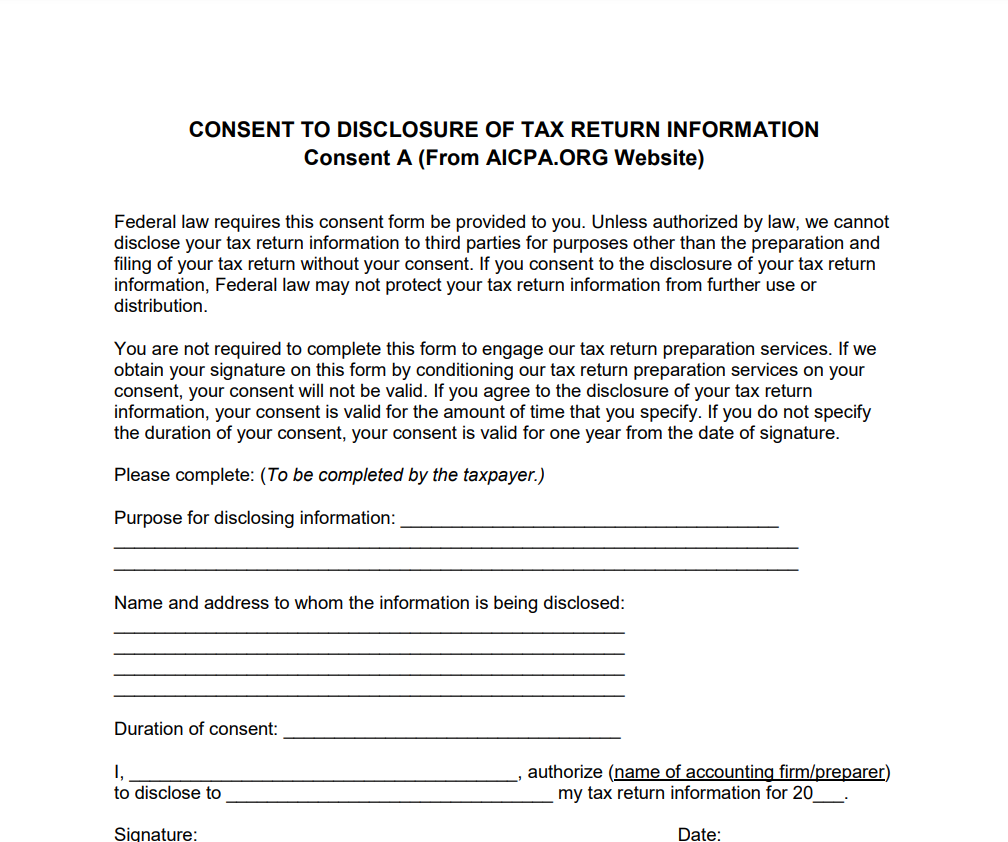

Generally speaking, you have to submit an signed Consent Form for your 1040-series tax returns. This form is mandated under federal laws. Without the consent form the tax return data is not allowed to be shared with anyone for any reason other than filing your tax return. In addition an Consent Form could not be adequate for all requirements and you might not be a fan of some or all of them.

IRS regulations, in effect from the 4th of January, 2010 stipulate that a tax return preparer receive consent form from each client prior to using taxpayer’s details. The regulations outline the IRS’s responsibilities in relation to protecting taxpayer information and impose criminal penalties for the unlawful use of information. This is particularly important for tax professionals who are preparing their 1040 tax series. Below are a few of the reasons the tax return preparer has to get the consent form from a customer.

It’s not necessary to file tax returns for the 1040 series.

It is important to note that the SS 7216 Consent Form is not necessary to be filled out for Form 1040 series tax returns. However, there are specific circumstances where you need to obtain the permission of the taxpayer. In particular, the tax professional can’t condition their services to clients upon obtaining their consent. Disclosure of taxpayer information should be limited to completion or submission of tax returns and the taxpayer must give consent prior to the time that information is made available to third individuals. Additionally, the consent form must specify the specific services or products that the taxpayer has agreed to receive.

In certain situations, the information of the taxpayer could be used to solicit information from an accountant. If this happens the tax preparer has to select specific services and products to be used in the solicitation. For instance, examples include: balance due mortgages, loans for mortgages, mutual funds as well as the individual retirement account, life insurance and many more. In general, a 7216 Consent Form should be used solely for disclosures of data concerning tax returns of the 1040 series; however, it is not required for other tax returns.

It’s not a violation.

If the CPA prepares tax returns for a client It is not in violation of the law to make that disclosure. But, the client should submit a copy consent form before they transfer documents. The consent should specify the period of period that the consent is in effect. In many instances it is a year. But, the law permits the disclosure of information to facilitate peer review and quality review.

It’s not a barrier to outsourcing

Although seven216 Consent Form could be a problem for certain companies but it’s not a barrier to outsourcing. Signatures on paper can be difficult to cancel However, digital signatures are safer. If you have the appropriate technology, the requirement for signatures is no longer an obstacle. Based on the type of service offered, businesses can outsource tax preparation and other services to overseas areas. In certain cases outsourcing may increase productivity.

A business that is outsourcing 1040 services will need to submit the 7216 Consent Form even if they are not offering tax advice to taxpayers. A 7216 Consent Form is required for offshore financial consulting companies. However the IRS is concerned regarding offshore companies. It could take time to implement these rules. As long as the business is in compliance with these rules and regulations, this 7216 Consent Form does not pose a problem to outsourcing.

Download 7216 Consent Form 2024